In an Open Economy a Decrease in the Money Supply

WHEN THERE IS EXCESS SUPPLY OF MONEY RBI SELLS GOVERNMENT SECURITIES THEREBY TAKING AWAY EXCESS LIQUIDITY. The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments.

Because a fixed exchange rate economy must keep the interest rate the same they will need to further decrease the money supply to restore the initial interest rate.

. Gross domestic product GDP is a measurement of the total value of all the finished goods and services. This will further lower output in the economy. This is followed by a.

In an open economy such as Canadas a decrease in the money supply leads to a rise in the interest rate. Hicks based on J. Macroeconomic Policies and Exchange Rate Regimes in the Short Run Demand in the Open Economy To analyze macroeconomic fluctuations.

There are several standard measures of the. The reason is that a decrease in aggregate demand assuming equilibrium in the IS - LM model decreases in the interest rate. With the complex global economy this can ripple out and affect other nations.

In an open economy such as Canadas a decrease in the money supply leads to a rise in the interest rate. This is followed by A an outflow of financial capital and an appreciation of the Canadian dollar. In an open economy such as Canadas a decrease in the money supply leads to a rise in the interest rate.

Monetary policy has international implications as well. Open market operation omo open market operation is the activity of buying and selling of government securities in open market to control the supply of money in banking system. Consider the monetary transmission mechanism.

The IS-LM Investment Savings-Liquidity preference Money supply model focuses on the equilibrium of the market for goods and services and the money marketIt basically shows the relationship between real output and interest rates. An inflow of financial capital and a depreciation of the Canadian dollar. The Fed can increase the money supply by lowering the reserve.

A balance of payment deficit causes the supply of dollars to rise lowering the dollar exchange rate and increasing aggregate demand for exports and demand for import-competing firms eventually eliminating the deficit. This is followed by O A. Goods and Forex Market Equilibria.

A balance of payment surplus increases the dollar exchange rate and reduces domestic. Goods labour credit and. In an open economy such as Canadas a decrease in the money supply leads to a rise in the interest rate.

Increases decreases in aggregate demand or aggregate supply result in rightward leftward shifts in these curves. Steel automobiles and building materials can all cost more. His is based on the equation of exchange where MV PQ V PQM in which PQ V and M are nominal GDP velocity of money and the supply of money.

An increase in money supply can also have negative effects on the economy. Demand in the Open Economy 2. Money supply refers to all the currency and other liquid instruments in a countrys economy.

Money supply and this affects interest rates which in turn affect investment and consumption spending In an open economy the interest rate changes will affect the demand for currency. In an open market. The money supply can be increased in an economy by purchasing government securities such as treasury bills and government bonds.

Changes in interest rates lead to changes in supply and demand in the foreign exchange market. In an open economy under flexible exchange rates where the central bank keeps money supply fixed a tax cut will cause an increase in which of the followingnet exportsthe exchange rate Eexportsall of the abovenone of the above. It causes the value of the dollar to decrease making foreign goods more expensive and domestic goods cheaper.

An inflow of financial capital and a depreciation of the Canadian dollar. An outflow of financial capital and a depreciation of the Canadian dollar. The reverse happens when the central bank tightens the money supply by selling securities on the open market drawing liquid funds out of the banking system.

Aggregate Demand in an Open Economy 1. What is the effect for a closed economy and for a small open economy. Currency and balances held in checking accounts and savings accounts are included in many measures of the money supply.

Deriving the IS Curve 4. Check out a sample QA here. Central banks use several methods called monetary policy to increase or decrease the amount of money in the economy.

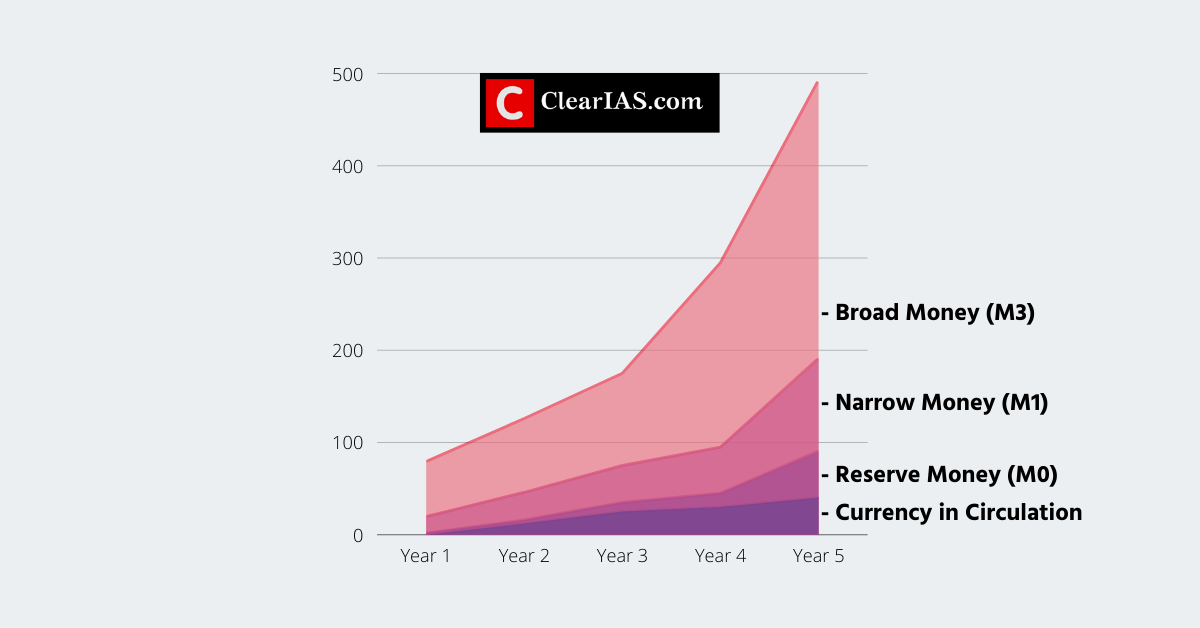

Monetary supply aggregates are the formal breakdown and measurement of money supply in the economy based on liquidity. In turn changes in exchange rates affect exports and imports and influence the overall demand for goods and services. The government can decrease the money supply and increase interest rates by selling securities.

Want to see the step-by-step answer. In an open economy such as Canadas a decrease in the money supply leads to a rise in the interest rate. The prices of such securities fall as supply is increased and interest rates rise.

This is followed by A an outflow of financial capital and an appreciation of the Canadian dollar. This intersection determines the equilibrium price level and output for the economy. Expansionary Macro Policy in a Closed Economy Increase money supply Decrease taxes andor increase government spending.

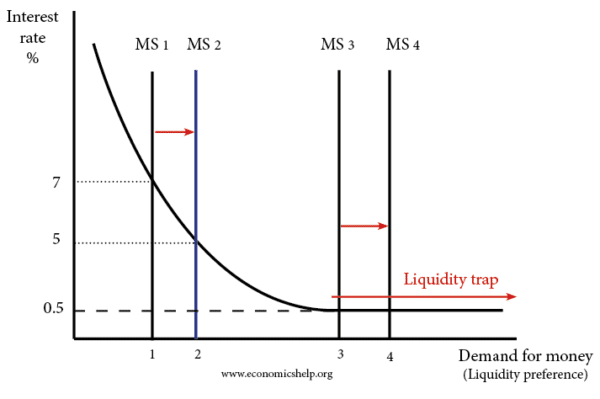

Keynes General Theory in which he analysed four markets. A Users Guide explains this connection. Explain how a decrease in the money supply affects the money market and the position of the aggregate demand curve.

9 Consider the monetary transmission mechanism in an open economy. Deriving the LM Curve 5. M0 is the most liquid category as it represents all the physical coinage and paper money in circulation.

It was developed by John R. Fiscal and Monetary Policy in an Open Economy. This is followed by A an outflow of financial capital and an appreciation of the Canadian dollar.

An outflow of financial capital and an appreciation of the Canadian dollar. Goods Market Equilibrium 3. The economy is in equilibrium where the aggregate demand curve intersects the aggregate supply curve.

Other things being equal a decrease in the domestic money supply leads to A an appreciation of the domestic currency thereby stimulating net exports and reducing aggregate demand.

Pin On Stuff Worth Reading And Knowing

Bu 340 Managerial Finance 1 Lesson 1 Quiz Answers Ashworth Finance Lessons Raising Capital Finance

Policies To Trigger Gradual Decrease In Lending Costs For Small Enterpriseschina S Monetary Policy Will In 2021 Months In A Year Monetary Policy Open Market Operation

Uae Financial Market Low Oil Price Takes Its Toll On Saudi Banks Financial Markets Stock Market Oils

What Is Money Supply Definition And Concept Explained Clearias

Bu 340 Managerial Finance 1 Lesson 1 Quiz Answers Ashworth Finance Lessons Raising Capital Finance

Money Supply Overview Monetary Aggregates Monetary Policy

Best Free Stock Trading Training Videos From Prorsi Stock Market Training Stock Trading Online Stock Trading

Increasing Money Supply Economics Help

Competition Sanctioned Companies Risk Up To 10 Of Their Turnover In 2022 Competition Morocco Workshop Organization

August 2017 Philly Fed Manufacturing Survey Marginally Declined But Remains In Expansion Financial Health Business Insider Global Economy

Monarch Is Trendsetter In Network Marketing Industry In 2022 Network Marketing Industry Network Marketing Marketing

Class 12th Thermodynamics Chemistry Handwritten Notes Pdf Handwritten Notes Chemistry Notes Thermodynamics

Inflation Vs Deflation Head To Head Difference Learn Economics Financial Literacy Lessons Teaching Economics

Inflation Vs Deflation Head To Head Difference Learn Economics Financial Literacy Lessons Teaching Economics

If You Are Looking To Purchase Your Dream House But Are Worried About The Budget Including Closing Costs Which Can B In 2022 Refinance Mortgage Title Insurance Lender

Nestle Admits That Less Than 30 Per Cent Of Its Products Fail Health Norms In 2021 Fails Economic Times Unhealthy

Comments

Post a Comment